how do business loans work in south africa

Kiva loans are facilitated through partner or direct models. You should expect delays.

Best Business Loans 2022 Small Business Start Up Loans

Unlike receiving a bursary student loans are meant to be repaid with interest once you have completed your qualification and earning a salary.

. You may need to provide collateral for the loan. Treasury has defined the principle of this loan scheme as collaborative ultimately meaning that profits and losses are shared between the banks and the South African Government. The 1st step is to apply online and then you must wait for step 2 which is the decision.

To assist you in obtaining the appropriate form of financing for your business here are three methods to use business loans. This form of loan which is available from a variety of lenders ranging from banks to specialized lending businesses may appear to be a quick and straightforward option to receive. While other company finance alternatives are available at business-loancoza such as bridging loans.

Apply online for free. Step 3 is receiving your funding if. At that point you will be informed as the amount of money you will be able to receive for subsidy.

Equity funding is not repaid like a bank loan. The process is done online and you get an answer on your application in a matter of hours. A Borrower Applies for a Loan.

There are several options where South African students can access loans for academic purposes - ranging from government organisations banks and private financial institutions. Kiva Loan Goes Through the Approval Process. You can only apply for a student loan as a student.

Debtor financing is a type of financing where a financial. They can be used for almost any purpose so whether youre looking to grow your workforce purchase a commercial property or simply plug a temporary cash flow gap our. Business loans in South Africa are available to mitigate the financial burden on sole proprietors.

Limited Liability Companies are more flexible to work with plus you will need managerial formalities like board of directors shareholders meetings etc. Traditional Short Term Business Loans. Which bank in South Africa offers the best for student loans.

How do business loans work in South Africa broken down by Loan Type 1. It is expected that while you are still serving your parent will be the one to pay the interest portion of the loan taken. For partner loans applicants apply to local Field Partners who manage the loan whereas for direct loans applicants apply through the Kiva website.

Each lender has their own acceptance criteria when it comes to issuing business loans which is why well work on your behalf to unearth finance partners who are best suited to your organisation. Factor fees typically range from 050 to 5 for each month an invoice remains unpaid. The value of the collateral must correspond to the level of risk which the lender assumes.

Expanding Your cubicles are overflowing and your new assistant has been forced to set up business in the canteen. You might find one lender requires an entirely different set of documentation from another or one comes with added benefits or longer loan periods. A student can use the FNB loan to pay for things like tuition fee hostel rent and other academic materials.

South African Governments COVID-19 Novel Coronavirus website. The Kiva loan process is as follows. The process could take up to 3 months so be willing to wait a while.

In order to apply for this subsidy program you will need to have approval in principle issued by a lender. In South Africa business loans can be used to fund both new and established firms. How do business loans work in South Africa broken down by Loan Type.

The scheme will receive the difference between the rate at which the banks lend the money together with limited costs. Unlike other loans which will normally demand that you start paying back money with interest right away many student loans will only require that you pay for the interest on the loan while. How do Student Loans Work in South Africa.

With Lulalend Business loans you can apply for a business loan between R10000 and R5000000. Collaborative Business Funding in South Africa. There are no physical forms to fill out and no need to submit supporting documentation like business plans and financial forecasts or budgets.

South Africas major banks all offer a range of loans for businesses. Debtors Factoring and Invoice Discounting. Apply with a parent with an income.

Simply due to the fact that business loans are quite complex and every lender will come with their own set of services and tailored products to match the needs of a variety of business types. How Do Student Loans Work In South Africa. How To Get Start Up Business Loans In South Africa Start Up Business Business Loans Start Up 1 Lulalend Business Loans 2020 Review Business Loans Best Payday Loans Cash Loans Online.

Get approved for a business advance of R10000. The process works in 3 easy steps. They earn dividends when the business makes money.

This amount will depend on how much you earn each month and it can be of 10000 rands to 87000. The amount of money offered by FNB ranges from R4000 to R80000 and the loan is available to any student who attends a recognized academic institution in South Africa. How Kiva Loans Work.

The first thing to note about student loans is that they tend to come with a certain grace period which activates during your studies. Bridgement allows you to apply for a revolving credit facility of up to R1000000. Get approved for a business advance of R10000 - R5000000.

What to expect when you are looking for business start-up loans in South Africa. After collection the factoring company pays your business the remaining balance minus the factoring fees. The National Department of Healths COVID-19 resource portal.

How To Get A Small Business Loan In 2022

Pin On Nicole Real Estate Marketing

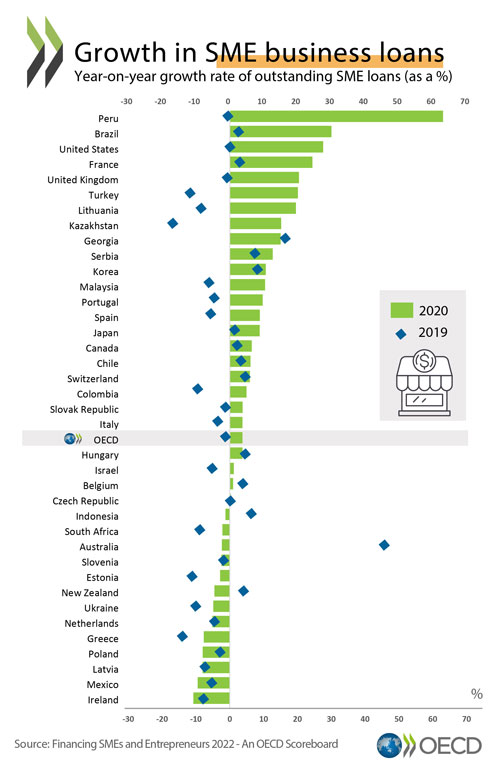

New Oecd Report Shows Loans To Smes Hit New Heights During The Pandemic As Small Firms Face Renewed Pressures During The Recovery Oecd

Fnb Is For The First Time Opening Its Award Winning Banking App For All Consumers In South Africa To Experienc Student Banking Student Bank Account Banking App

Apply For Working Capital Loans In South Africa Good Credit How To Apply Loan

Best Business Loans 2022 Small Business Start Up Loans

Free New Business Loan Request Letter To Bank Manager Template Google Docs Word Outlook Apple Pages Template Net

Best Business Loans 2022 Small Business Start Up Loans

Real Estate Investor Magazine South Africa November 2019

Commercial Residential Property Development Finance Funding In South Africa

Top 10 International Business Funding For Africans Online Dailys Business Funding Small Business Funding Business Investors

How To Get A Small Business Loan In 2022

Top 10 Loan Classified Sites In Africa Post Free Loan Classifieds Ads In South Africa Ads2020 Marketing

Business Partners Business Loan Review 2020

How To Get A Small Business Loan In 2022

Why Compete For Funding From Investors When You Can Let Investors Compete To Fund You Visit Sign Up At Www Biztechp2p Com Let It Be Investing Competing

Private Loan Agreement Template Free Free Printable Documents