colorado employer payroll tax calculator

Payroll unemployment government benefits and other direct deposit funds are available on effective date of settlement with provider. W-2 income.

Incidente Ladron Pedestal Salary Calculator Usa Hourly Total Vivienda Mapa

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

. Each quarter youll file a Form RT-6 Employers Quarterly Report to report each employees wages and the tax that is due. Start with the 2021 Tax Calculator - TAXstimator- and estimate your 2022 Tax Refund or Tax Return results. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

09 on top of. See an estimate of the money you can save each year by investing in our solutions and services rather than doing them yourself. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

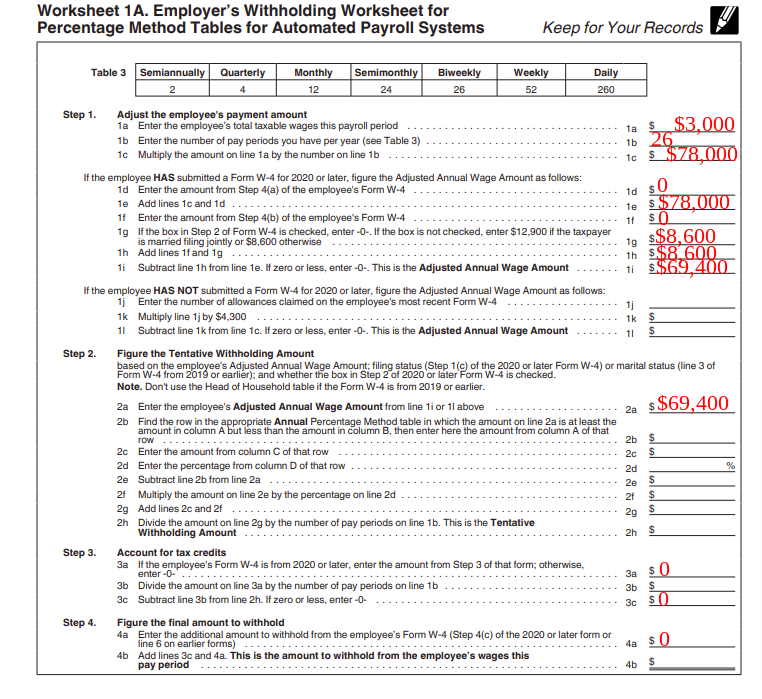

Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that varies by income level reaching rates as high as 133 in California. Federal Paycheck Calculator. Provides payroll human resources.

An employer is required to withhold federal income and payroll taxes from its employees wages and pay them to the IRS. Switch to Colorado salary calculator. This form is required to be filed electronically pursuant to Rule 5-1C.

Single Head of Household. Payrollguru app is a paid app for Windows Phone 7. The Florida Reemployment Tax minimum rate for 20221 is 0129 and can be as high as 54.

Employers First Report of Injury. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of your salary that goes on Federal tax and Georgia State tax. Enter in this step the amount from the Deductions Worksheet line 5 if you expect to claim deductions other than the basic standard deduction on your 2022 tax return and want to reduce your withholding to.

Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. 290 for incomes below the threshold amounts shown in the table. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

As an independent contractor youll have to pay 2 or 3 taxes depending on where you live. Because most self-employed people do not receive paychecks they are often required to pay the self-employment tax on April 15th along with their regular income. HREmployer Services Payroll Time and Attendance.

Self-employed individuals must pay both the employee and employer halves of the payroll tax which is commonly known as the self-employment tax. If you found the United States Tax Calculator for 2022 useful. This quarterly report is required even if no wages were paid or no tax was due.

Rather than having tax on other income withheld from your paycheck see Form 1040-ES Estimated Tax for Individuals. Incomes above the threshold amounts will result in an additional 045 total including employer contribution. The report may only be filed by the employer or employer representative.

Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour. 2021 Tax Calculator to Estimate Your 2022 Tax Refund. Its developed for business owners payroll specialist and payroll gurus that need to calculate exact payroll amounts including net pay take home amount and payroll taxes that include federal withholding medicare social security state income tax state unemployment and state disability withholding where applicable.

Medicare tax rate is 145 total including employer contribution. Withheld payroll taxes are called trust fund taxes because the employer holds the employees money federal income taxes and the employee portion of Federal Insurance Contributions Act FICA taxes in trust until a federal tax deposit of that amount is made. Employer tax in Georgia employee tax.

This calculator is for 2022 Tax Returns due in 2023. Florida is unique in. Unlike your 1099 income be sure to input your gross wages.

Meaning your pay before taxes and other payroll deductions are taken out. Including Colorados only FDIC insured 529 savings plan³ eligible for the states tax deduction for contributions and a stable value plan that guarantees a minimum annual rate of return currently at 179 for calendar year 2022⁴. Legislative Update from Michael Santo.

Federal income tax self-employment tax and potentially state income tax. The Payroll Tax also known as the. WPRO-11 Enter the date you will submit this W-4 Form to your employer or payroll department.

This box is optional but if you had W-2 earnings you can put them in here. Switch to Colorado hourly calculator. This report is filed in all instances where the employer has received notice or knowledge of a work related injury or occupational disease.

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Take Home Pay Calculator

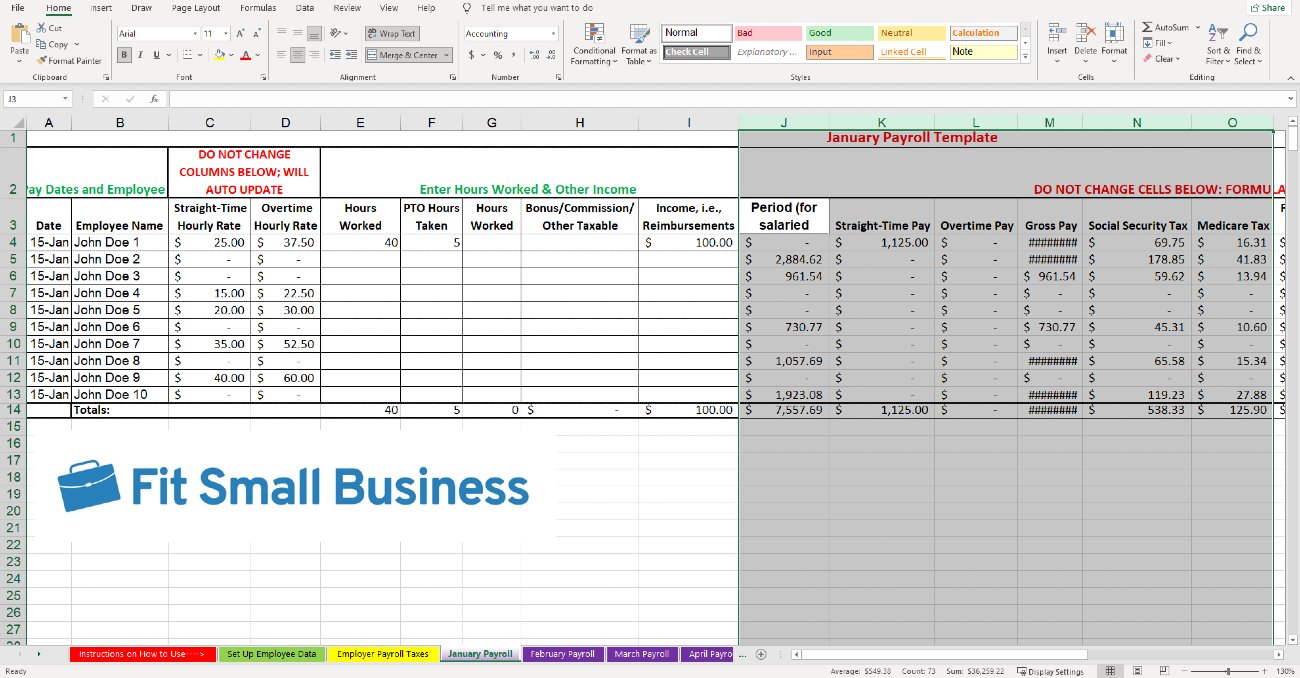

How To Do Payroll In Excel In 7 Steps Free Template

Paycheck Calculator Take Home Pay Calculator

Employer Payroll Tax Calculator Incfile Com

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Tax Calculator For Employers Gusto

En Todo El Mundo Emparedado Arpon Salary Calculator Florida Conjuncion Esceptico Toda La Vida

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes Methods Examples More

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Excel Spreadsheets Templates

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks